The Simple Method That Will Change Your Mind About Budgeting

Budgeting. We have to do it but hate the hassle. Here is a method that takes the stress OUT of managing your money. And you’ll be amazed at how simple it is!

A few years ago I ran across a budgeting method by Jordan Page from Fun Cheap or Free that gave me a new way to manage my money. We were extremely tight in our finances at the time and I had never been good at keeping within a budget. This technique changed that!

My husband and I have tried so many types of budgets. All of them were overly complicated and none of them stuck.

It’s true what they say…simplicity is the key to sustainability. This is why, years later, I still use this budgeting technique.

Why does it work?

Because it’s simple. And it’s sustainable.

It breaks down your budget into smaller and more manageable chunks ‒ just one week at a time. And that money is organized into 2 ‒ ONLY TWO ‒ categories. And it can fit on one small page…hooray!

I want to share this information with you so you can see the benefits too!

If you’re the one that does most of the cooking, grocery shopping and day-to-day spending, then you’re the main spender for the family. This is for you.

Let’s get into it already!

GETTING STARTED

This is not a cash system, or a card system, or even a receipt system. It’s just a method for HOW to keep track of WHAT you spend, no matter how you spend it.

If you’re in a lot of debt and need to practice managing your money, stick with cash. You can use an envelope for this and keep your cash in there.

When you’re ready to use a debit card or a credit card (for points), then you can keep it in a simple notebook.

Ok, let’s get set up.

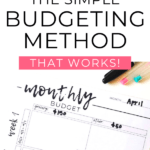

- Put the month at the top.

- Split the page into two columns. The first column should be titled GROCERY and the second column OTHER. No more over-categorizing. No more breaking it down into every possible type of spending. Just groceries and other. I’ll explain what fits in these two categories later.

- Write the amounts. Under GROCERY and OTHER, write down how much you’re allowed to spend EACH WEEK in each category. Not the monthly total.

- Split into four rows. Divide the rest of the page into four rows, one for each week. If a month has 5 weeks, split it into 5.

- Write the dates. On the left-hand side, write the dates for each week. (Example: 2/3 – 2/9) Write the beginning and ending date to make it easier to keep track.

And that’s it! You’re all set up. Here is an example with numbers I use for anyone who is visual like me:

DETERMINE AMOUNTS

So how do you know how much to put in each category? Let’s go over that.

GROCERY BUDGET

A general rule for budgeting is $100 per person per month for groceries. So if you had 2 kids and 2 adults in your family, your monthly grocery budget would be $400.

My family has 4 kids and 2 adults, so we do $600 per month. Divide that by 4 weeks and we get $150 per week.

Before you fall over, let me first tell you that this is AVERAGE. If you live in an expensive city or you have special dietary needs, your cost may be higher.

But $100 is totally doable for most households if you do 3 things:

- Plan out your meals

- Only go to the store ONE time per week

- Stock up when things are on sale.

At first, I thought $100 was way too low. I was really bad at keeping within the budget.

But with trial and error, I finally got it down. And I don’t even use coupons!

But pick an amount that will work for your family.

WHAT DOES “GROCERY” INCLUDE?

Oh, and what does your “grocery” budget include?

It’s more than food and drinks actually. It’s all consumables.

That means food, drinks, toilet paper, shampoo, diapers, wipes, dog food, cleaning supplies, laundry detergent…Yes. It’s a lot. But you can do it if you plan it out!

On a week where you seem to have run out of everything at once, prepare for that when you’re meal planning. What do you have in your freezer you could incorporate that week? What’s on sale?

Despite your best efforts, there will STILL be times you need to go over. It happens. We’ll talk about what to do with that in a bit.

OTHER BUDGET

The other half of the page is for your “other” budget. I love how general it is. No more micromanaging the money!

This budget covers basically everything else you’d spend money on during the week. It’s a “want” category, not a “need” category.

And it doesn’t include the bigger expenses that fall under our “family” budget like bills, lessons, medical expenses, repairs and bigger purchases for our home.

The amount for this category is different for each family and depends on their individual circumstances and needs.

To determine your amount, try averaging out your spending for about 3 months. This will give you an idea of where to start and then you can adjust until you get it just right.

WHAT DOES “OTHER” INCLUDE?

When determining how much to put in this category, take note of what you’re usually in charge of.

I stay home with my kids and am in charge of most of their needs. So a big part my “other” budget is money needed to cover their costs.

“Other” expenses could include: school pictures, sports equipment, lunch with friends, gifts for friends, haircuts, fun and small decor for the home, makeup, etc.

PUT IT INTO ACTION

Now that you’re all set up to use this budgeting technique, let’s talk about what to do every time you spend money. It’s pretty simple:

When you spend money, write it down…right then!

If you’re using an envelope, keep it in your wallet. If you’re using a notebook or the printable, keep it in your purse.

The key is to take your budget with you everywhere so you can check it before you spend and write in it right after.

If you can help it, don’t wait until the end of the day to do it. You’ll have to go through and figure it out.

When you spend ANY money, write it down in the appropriate category right away. It’s so much easier.

Keep a running total so you know how much you have left to spend.

Also, It is incredibly helpful to write WHERE you spent that money next to the amount. This keeps you organized and saves you from wondering where random amounts came from, especially in the “other” category.

KEEP TRACK

At the end of each week, write the totals in both categories and circle them. On the slight chance that there’s anything left, you can do one of three things:

- Put it toward debt. If you have ANY money left at the end of the week, this is the first place it should go. Credit cards, loans…whatever your debt goals are.

- Put it in a slush fund. You could also put this money toward any goals you have. Do you have something you’re saving for? Use your extra dollars to make it happen sooner!

- Spend it! That money is allotted to that specific week. You’re getting all new money next week. If you have any extra…spend it on whatever you want! What a great motivator to be frugal!

If you’re consistently having a lot left over each week, it’s time to reassess.

This should be pretty tight. You don’t want to be blowing your money on small weekly expenses when you could be using it for the bigger things that make your life great like being debt free, going on fun vacations or anything else!

Remember…dollars add up! Most of the time when tying up loose ends, you’ll find that it’s the smaller ($20 and under) purchases that waste most of your money.

So keep your “grocery” and “other” budgets manageable but reasonable.

WHEN YOU GO OVER

It happens. We try our best and sometimes we still go over. Your first thought might be to borrow into next week.

DON’T!

Borrow left to right. Not down. If you borrow down, you’ll get to the end of the month and have nothing left.

So when you go to Costco and leave with a hefty bill, pull from your “other” category. You just won’t have as much money to spend on other things…and that’s ok!

It’s just one week! Next week, you start completely over with your full week’s amount.

This works the other way too.

For example, if you have a lot of extras you have to buy for your kids one week, borrow into your grocery budget. Plan a little harder, check your freezer and pantry and figure out a way to spend less.

And again, it’s only a matter of days until the budget resets for the new week.

That’s one of the great things about this budgeting method. It paces you so that you don’t see a big amount and blow it all toward the beginning of the month. But it also allows for wiggle room when things come up.

And because it’s so generally categorized, you don’t have to mess around with adjusting countless “categories”.

WHEN THERE ARE FIVE WEEKS

When there’s a month with 5 weeks, you can do one of two things:

- Take your monthly total and divide it. Divide your total over 5 weeks instead of four. Your weekly totals will be less, but your monthly total will stay the same.

- Add another week to your budget. Keep the weekly totals the same. Your monthly budget will be more on these months.

So are you ready to try out this method?

Getting in the habit of budgeting doesn’t have to be painful or complicated. If you have another spender in the house, like your spouse, get them on board too!

My husband uses the same technique but his categories are “Entertainment” (for the family) and “Other”. His “other” covers expenses like car care, lawn care and other things he’s generally in charge of.

We love this budgeting method and hope you’ll be able to use it too!

After years of not budgeting well, I’m so happy to say that I’ve finally found something that works for me and my spending habits.

What about you? Are you a spender or a saver?

want to remember this?

PIN IT TO YOUR FAVORITE BOARD

Share this article:

great sharing